Meet the Brooklyn judge Betty Williams.

Judge Betty Williams is well known to New Yorkers for her double-dipping, running for re-election after she turned 70, which is a mandatory retirement age for judges, retiring within 8 weeks of election, and then remaining on the bench after "certification" and collecting both her $174,000 a year salary, and her $135,902 a year pension.

How did I determine that Judge Williams turned 70 before her re-election?

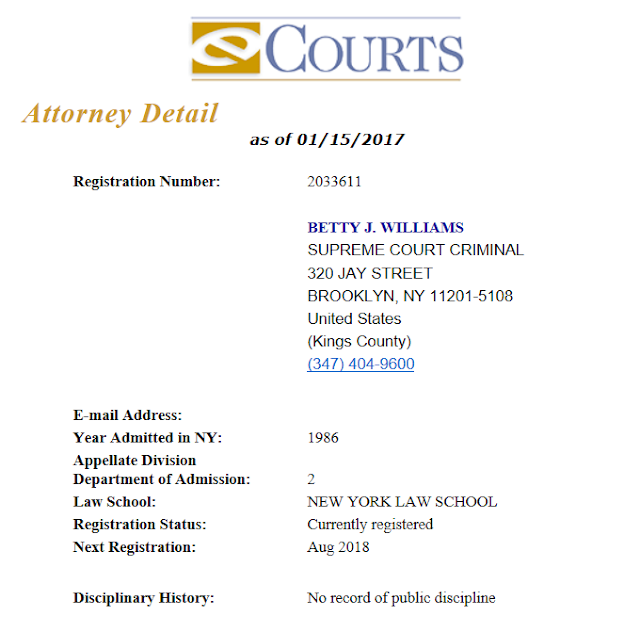

Judge Williams' attorney registration indicates that she will have to re-register in August of 2018. Attorney registration rules in New York require attorneys to re-register every two years, within 30 days of their birthdays, and an attorney next registration date shows the month of the attorney's birthday.

The month of Judge Williams' birthday is August.

In New York, judges must retire on January 1 following the year when they turned 70.

Judge Williams' retirement date is listed as December 30, 2013.

The election committees and donors who supported Judge Williams in her re-election bid had to know about this double-dipping scheme.

This scheme alone says a lot about integrity of Judge Betty Williams.

Here are Judge Betty Williams' salary payouts - paid by New York taxpayers - reported by Seethroughny.net since 2009, and her pension payouts reported since 2014, after she retired in 2013:

Betty Williams worked as a judge in 2016, and remains on the bench in 2017, as her attorney registration indicates, even though she is not listed as a judge in the New York State judicial directory:

and, according to an answer of the New York State Commission for Judicial Conduct to me about another retired, but still "serving" judge, Judge Betty Williams is not subject to jurisdiction of the NYS Commission for Judicial Conduct, so she can do on the bench whatever she likes - and she is covered with judicial immunity, attorney disciplinary committees or criminal authorities will not dare to touch her for any misconduct on the bench, and the New York Judicial Conduct claims it does not have "authority" to discipline misconduct of retired judges - even if they continue to serve.

Reportedly, many judges do what judge Betty Williams does - collecting both her salary and pension after MANDATORY retirement and "certification" allowing, by court rule only, New York judges to remain on the bench for 6 more years after the mandatory age of retirement of 70 - in 3 2-year increments.

Here is attorney registration of the Rockland Surrogate Judge Thomas E. Walsh II

Here are the salary payouts for Judge Thomas E. Walsh II after retirement:

Here are Judge Thomas E Walsh, II's retirement payouts since 2010:

Judge Thomas E. Walsh, II reportedly draws not only a pension of $105,000, a salary of $170,000 as a state judge, and, an additional salary of $4,200 as a surrogate.

In 2013, after New York Governor Andrew Cuomo complained about double-dipping judges, and while awaiting the vote on the constitutional amendment to raise mandatory retirement age for judges from 70 to 80, New York courts, at that point headed by Chief Judge Jonathan Lippman who was the ardent supporter of raising the mandatory retirement age - because it would have allowed him to stay on the bench, while Governor Cuomo was fighting against the amendment, in order to plant his personal friend Janet DiFiore in Jonathan Lippman's stead (Cuomo won) - at that historical time, Lippman's court system tried to cater to the voters and, after Cuomo complained about double-dipping, reportedly stopped paying out judicial salaries to retired judges.

Not for long, though.

First, New York voters did not approve raising mandatory retirement age for judges from 70 to 80.

Second, judges sued.

After the only honest judge in this whole situation, the Acting Supreme Court Justice Gerald W. Connolly of the Albany County Supreme Court,

prohibited the double-dipping, the notoriously corrupt Appellate Division Third Judicial Department, Judges McCarthy, Egan, Devine and Clark - in a court whose Chief Judge Karen Peters, as well as several other judges, is close to retirement herself and stood to benefit from their decision personally - reversed Judge Connolly, claiming that to prohibit "double-dipping" to retired judges means to violate New York State Constitution, Article V, paragraph 7, Judiciary Law 115(3) and Retirement and Social Security Law Section 212.

First, this is the court that usually do not give a damn to whatever State and Federal Constitution, or statutes say - unless, obviously, it concerns judges themselves.

Second, the ruling was plain wrong on its face.

New York State Constitution, Article V, Paragraph 7 says:

"§7. After July first, nineteen hundred forty, membership in any pension or retirement system of the state or of a civil division thereof shall be a contractual relationship, the benefits of which shall not be diminished or impaired. (New. Adopted by Constitutional Convention of 1938 and approved by vote of the people November 8, 1938.)"

Nobody is taking judges' pensions, but hiring retired judges, after MANDATORY retirement, for a full salaried position from which they HAD TO retire due to their age - while they draw both their pension and their salary, while there is an abundance of young lawyers in the State of New York who could serve as a judge (if there are no enough judges) more effectively than 70+ retired judges - is just plain wrong, as well as wasteful of taxpayer money.

provisions of section one hundred one, two hundred eleven or four

hundred one of this chapter or of section five hundred three of the

education law, or the provisions of any local law or charter, any

retired person may continue as retired and, without loss, suspension or

diminution of his or her retirement allowance, earn in a position or

positions in public service in any calendar year an amount not exceeding

the amount set forth in the table in subdivision two of this section

provided such retired person employed under this section duly executes

and files with the retirement system from which he or she is receiving a

retirement allowance a statement that he elects to have the provisions

of this section apply to him or her. A statement of election executed

and filed pursuant to this section may be withdrawn by a retired person

at any time by a statement similarly executed and filed. However, there

shall be no earning limitations under the provisions of this section on

or after the calendar year in which any retired person attains age

sixty-five. The retirement board of the New York state teachers'

retirement system is authorized to adopt rules and regulations which

would allow retired persons receiving a retirement allowance from such

system to make such statements of earnings from a position or positions

in public service as such board shall determine necessary to enforce the

provisions of this section in lieu of the foregoing statement of

election".

And, later, judges also sued to collect the "back pay" because of the alleged multi-year salary freeze - which was not granted by the New York State Court of Appeals.

But, what was granted to the judges presently on the bench, is that in 2015 the "Judicial Compensation Commission" consisting mainly of attorneys who derived their livelihood from judges, were regulated by judges, and thus wholly depended on good graces of judges, raised judicial salaries - the law that went into effect in 2016, and judges who are currently double-dipping benefit from the raised salaries.

Here is what one of the double-dipping judges say about their alleged right to double-dip: he is absolutely ok about it, naturally, since it concerns himself personally.

Now we will get a chance to see whether the NYS Court of Appeals, a court that claims that it "gets to pick its cases", will "pick" this case, in which each and every judge of the Court of Appeals has a financial interest, and whether it will decide in favor of its own judges - and to benefit the just-retired Judge Piggott who is benefiting from double-dipping right now.

I will continue to monitor the lawsuit of judges asserting their right to double-dip into taxpayers' pockets.

Meanwhile, I will monitor and publish analysis of decisions of double-dipping judges so that New York taxpayers should decided whether they need to demand from their legal representatives to strictly enforce the mandatory 70-year requirement, or to continue to allow judges to disregard the requirements of the New York State Constitution, act as judges after turning 70, and fleecing the public for substandard work and unlawful decisions.

Let's note that the raise in judicial salaries and judicial double-dipping after mandatory retirement age continues while New York Governor just vetoed funding of indigent criminal defense out of the state budget - for lack of funds.

Let's also note that retired judges are "certificated" because they are allegedly needed to help promote the business of New York Supreme Court:, according to Judiciary Law 115:

The statute does not indicate whether extra expenditures to pay out salaries of "certificated" judges are provided for in the State budget.

Yet, on December 4, 2016, the very same double-dipping judge Betty Williams was removed from certificated judges and cannot any longer continue to be a judge - even though she did not yet re-register as an attorney and still continues to list herself as a judge - because, reportedly, she could not cope with court caseloads.

It is an interesting decision by State Chief Judge DiFiore who, while having a certificated judge's "double-dipping" lawsuit pending on appeal, is herself dealing with certification and denying certification as the Chief Court administrator - a clear conflict of interest.

As to the decision to deny re-certification to the 74-year-old Judge Betty Williams, reportedly, Judge Betty Williams ripped the decision denying her re-certification and effectively removing her from the bench, which will cost her $174,000 a year in lost earnings.

That was reported on December 4, 2016.

Two weeks after the double-dipping Judge Betty Williams ripped up the decision effectively removing her from the bench - as of January 1, 2017 - Judge Betty Williams took her rage out on a criminal defendant, a national of the State of Israel who needed an interpreter in court proceedings and against his attorney for trying to do his job for his client, and unlawfully changed provisions of Criminal Procedure Law, thus demonstrating that not only she could not handle court caseloads, but she also lacks the very basic competence and integrity.

I will analyze Judge Betty Williams' outrageous December 16, 2016 decision in a separate blog.

I will also continue to analyze in separate blogs the strain on the budget put by the double-dipping judges, and constitutionality of such double-dipping, as well as of judges' acting as judges after the constitutionally mandated retirement.

And, by the way, now Judge Williams, at least theoretically, has a right to sue New York State Judge Janet DiFiore, and Chief Administrative Judge Marks - both in federal, and in state court.

In 2006 such a lawsuit was filed by judge Frank Pontiero - it was denied, but rules were set as to how such a lawsuit should be frame in order to win it.

We will see whether now Judge Williams will sue Judges DiFiore and Marks. If she does, I will report on that lawsuit, too.

Stay tuned.

No comments:

Post a Comment